CRISIL has reaffirmed 'AAA/Stable/A1+' on the bank facilities of ITC. The ratings continue to reflect ITC's excellent business risk profile with a presence in diverse businesses, dominant position in the Indian cigarette market, and strong sustainable profitability.

CRISIL has reaffirmed 'AAA/Stable/A1+' on the bank facilities of ITC. The ratings continue to reflect ITC's excellent business risk profile with a presence in diverse businesses, dominant position in the Indian cigarette market, and strong sustainable profitability.

The ratings also factor in the company's exceptionally strong financial position. These rating strengths are partially offset by ITC's exposure to risks inherent in the business segments in which it operates.

The ratings also factor in the company's exceptionally strong financial position. These rating strengths are partially offset by ITC's exposure to risks inherent in the business segments in which it operates.

CRISIL believes that ITC will maintain its robust financial risk profile and strong position in the cigarettes, hotels, paperboards, paper, packaging, and agriculture-based products segments in India over the medium term. The company's cash flows will be sufficient to fund its capital expenditure requirements over this period. The outlook may be revised to 'Negative' if ITC makes a large debt-funded acquisition, thereby adversely impacting its financial risk profile.

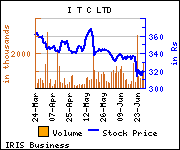

Shares of the company declined Rs 8.8, or 2.64%, to trade at Rs 324.90. The total volume of shares traded was 1,550,516 at the BSE (1.32 p.m., Monday).